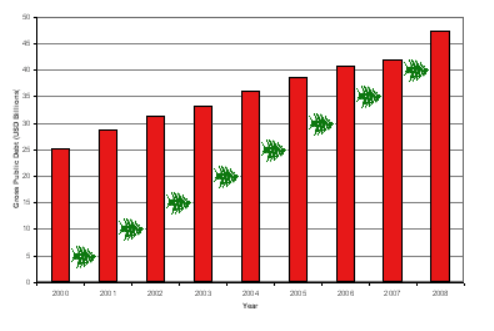

In addition to being responsible for Shakira, the biggest plate of hummus in the world, and Hank the Angry Drunken Dwarf, the Lebanese can be proud of another dubious distinction: their enormous national debt, which is said to be in the neighborhood of $47-52 billion. Measured per capita or as a percentage of GDP, it is one of the highest in the world.

In addition to being responsible for Shakira, the biggest plate of hummus in the world, and Hank the Angry Drunken Dwarf, the Lebanese can be proud of another dubious distinction: their enormous national debt, which is said to be in the neighborhood of $47-52 billion. Measured per capita or as a percentage of GDP, it is one of the highest in the world.

Like everything in Lebanon, the debt issue is highly politicized. There are two prevailing narratives about where it came from and who is responsible:

- At the end of the Civil War, Rafiq al-Hariri came along and financed Lebanon’s reconstruction by lending the government money from his banks and the banks of his friends (indeed, something like 70% of the debt is domestic). As prime minister, he could easily approve the exorbitant interest rates and transfer fees that he (as lender) was charging the government, which enriched him and impoverished the country. This is the argument in a nutshell, but you can read a far more in-depth treatment here (in French).

- At the end of the Civil War, Rafiq al-Hariri came along and financed Lebanon’s reconstruction… when nobody else would. He led the effort by investing his own funds, which had the effect of increasing investor confidence, bringing expatriate Lebanese back to their homeland, and strengthening the economy. When prosperity failed to materialize overnight (as a result of the Syrian occupation, the wars with Israel, etc.) Lebanon sank deeper into debt.

Most believe that something drastic needs to be done about the debt, regardless of which of the above narratives one subscribes to. Of course, one’s views about the sources of the debt necessarily inflect one’s preferred antidote. Here are some frequently-encountered proposals:

- Privatize certain sectors like telecommunications and energy, and use the billions in profits to pay down the debt.

- Liquidate some of the Central Bank’s enormous gold reserves to pay it down.

- Find a way to increase the tax base.

- Restructure the debt or default on it altogether.

A reader of this blog, Ghassan Karam, has written the following commentary arguing in favor of solution #4, which I publish with his permission. Should stimulate discussion.

*

To Default or Not To Default…

By Ghassan Karam

There comes a point when an ever expanding level of debt and the ability to service it become unsustainable. It is my belief that the state of Lebanon has reached this stage. A Lebanese national debt of over $50 billion and rising is being fueled by a huge annual deficit that is also unsustainable in its own way. The urgency of the situation is put in sharp focus when the debt service of almost $5 billion annually is factored in. That sum is larger than the total of remittances by the Lebanese nationals who are working abroad and it is also greater than the estimated annual earnings from tourism. It must be ironic when all the revenue from the countries’ most vibrant economic sector is essentially wiped out by interest payments on the national debt.

One common indicator of a country’s ability to carry a debt burden is to express the debt service as a percent of its total earnings from exports. By that measure Lebanon already devotes close to half of these earnings to debt service which makes it the fourth such highest proportion in the world. For comparison, Egypt spends 10% Jordan 9% and Tunis 14%. Furthermore, I estimate the Lebanese GDP to reach the $50 billion mark by 2020 and the Lebanese National debt to exceed $75 billion by then. These modest projections imply a debt service requirement of around $7 billion a year which is around 14 % of the GDP. If the Lebanese Government budget is to be around 25% of the GDP then in a decade over half of the Lebanese budget will have to be earmarked to debt service.

The ability of an individual, institution or state to carry on the burden associated with a certain level of indebtedness rests on some rather strict parameters regarding the size of the debt relative to the estimated income in addition to the conditions under which the debt in question has been issued. The relative size of the Lebanese official debt as a percent of GDP is already one of the highest in the world. In addition the fiscal deficit, at over 10% of the GDP, is also one of the highest deficit gaps in the world. Both are judged to be unsustainable. How can they be sustainable when the estimated annual growth in the economy falls short of even meeting the annual interest obligations not to mention the need to finance every year the new fiscal deficit?

Lebanon has no choice but to stop the national hemorrhaging by taking preparatory steps to restructure its government obligations. A good place to start would be the Paris Club that specializes in debt restructuring. The current Lebanese government should not shy away from considering either an outright default or at least a debt moratorium on all its obligations if a major restructuring agreement to wipe out at least 80 % of its current obligations is not arranged.

Such major steps are not to be taken lightly but they are not to be unrealistically feared also. Argentina has defaulted 5 times over the past century or so and each time it regains its economic vigour and access to the international capital markets. The recent unilateral and sudden demand by Dubai World for restructuring most of its debt is another instructive case about the debilitating effects of an unsustainable debt burden and a possible mean for diminishing its severity.

Until such possibilities are studied seriously the Lebanese Finance Ministry must stop in due haste its misguided policies of seeking more risk. Minister Raya Hassan was very proud in announcing the recent ability of the Lebanese state to issue $750 million worth of Eurobonds. These efforts that have gone so far unchallenged both by the press and other government members should cease immediately. External debt adds a new dimension to the problem of Lebanese indebtedness, that of an annual outflow of scarce capital. Very few countries, if any, are in a position to seek proactively to increase the rate at which financial capital is drained from the state.

An equally serious risk, which a rational investor shirks, is the added exposure to foreign exchange risk that comes neatly packaged whenever a portion of the domestic debt is reissued in foreign currency denominations. It must also be emphasized that the Finance Ministry has been less than forthcoming when it boasts of its ability to obtain 5 year paper at 5.87% interest and 7 year paper at 7% interest. Ms. Hassan did not find it convenient to mention that the going market rates for the above maturities are 2.03% and 2.74% respectively. .

In conclusion it is clear that the Lebanese authorities must take meaningful action to reduce the annual fiscal deficit, restructure the hugely unsustainable Lebanese debt before it evolves into a major uncontrollable crisis. They need to embark immediately on a path of reducing the exposure to foreign currency and external ownership.

*

Update: The Lebanese Ministry of Finance has a substantial number of reports and publications available on its website. Click here for the latest report on the public debt (PDF).

I’m afraid this post, unlike previous writings, is riddled with inconsistencies as well as assertions or projections that are not backed by any serious research. The conclusion is also not logical. I’ve only skimmed through this but my points are as follows:

* To get facts right first, Lebanon did not issue $750m in Eurobonds. It issued $500m in two tranches, due 2015 and 2024, each worth $250m

* Whilst it is true that the most of the debt is domestic, the assertion that Hariri and ‘his banks’ financed the government is untrue. Most of the banks in Lebanon are NOT owned by Hariri (e.g. BLOM, Audi – the biggest trader of Lebanese Eurobonds, Byblos etc.) and the banks / government have a visceral need to continue financing each other. For example, the Central Bank encourages high deposit rates relative to Fed rates on USD accounts, preferring liquidity over profitability for banks. To cover this interest, the banks subscribe to Lebanese government bills at c.6-7% coupons (the recent two bonds were 5.875% and 7% respectively), which is still very competitive for Lebanon’s ‘single B’ credit rating

* I find the projection of $75bn by 2020 to be arbitrary. What’s it based on, and why is it a ‘modest’ estimate? I agree this number can be high if the government runs budget deficits and Israel bombs lebanon a further few times (it’s not just mismanagement)

* The debt servicing (of at least the foreign currency debt, most of which is locally held), comes to around $1.5bn per year as most of the principal amount is being refinanced (see link below)

* Supposing the remaining points of the post are true, then in international markets, no one calls a moratorium, or a default unless it is really the case that debts can no longer be serviced. You do NOT suddenly turn around and say I don’t feel like paying the debt. Argentina defaulted because it couldn’t meet its obligations. Dubai World is restructuring part of its debt because it is unable to meet an upcoming $3.5bn sukuk bond on 14 Dec without drastically altering it’s normal operations, e.g. by selling assets. So far, Lebanon has been very able to continue re-financing its debt. Anyways, the only investors a moratorium would hurt are the Lebanese Banks.

Poorly thought out article…

I would point any interested reader to the Ministry of Finance’s website (http://www.finance.gov.lb) and to this document especially if you’re interested in Lebanon’s Eurobonds (does not include the last $500m issued):

Click to access EUROMAIN31October2009.pdf

Posted by Shadi | December 11, 2009, 5:55 pmDid you ever wonder how Lebanon’s banks were able to pay a Madoffesque, risk-free 8% interest rate ?

If you think that the debt is mostly owned by foreigners, you are wrong. The debt is held by ordinary Lebanese citizens, thanks to reckless and irresponsible Lebanese bankers who invested our savings into Hariri’s (and Berri’s, and Murr’s, and Jumblat’s) junk bonds. A special thanks to national genius and Hariri minion Riyad Salame who prevented the banks from lending to normal businesses (too risky you see, but what’s the point of financial sector that doesn’t finance productive investement) and instead directed our country’s savings into Hariri’s (and Berri’s, and Murr’s, and Jumblat’s) junk bonds.

At some point a dramatic event will cause many people to cash their savings at the same time. The system will collapse and God knows what will ensue. All Ponzi schemes eventually collapse, but there is no telling when.

And if you think that our Arab friends will not let us down, because Lebanon is the center of world and it is of such a strategic importance, just ask Sheikh ‘Mo’ al-Maktoum, now the nominal ruler of Dubai, who was let down by his own cousins. A loan shark enslaved by debt after enslaving so many, isn’t it ironic?

To paraphrase Ron Paul, you can’t borrow your way into prosperity (but you can sure try).

Posted by Vox P. | December 11, 2009, 6:09 pm1)Unless we’re talking about high-school grades, B grade debt is deep into junk bond territory.

2)Greek bonds trade at a spread of 2% compared to German bonds and are considered risky. Lebanon’s debt trades at a spread of 3.25%

3)The debt is financed with the deposits that the Lebanese people (and some foreigners) entrusted to banks. I’d love to see politicians lose their shirt on that one, but if history teaches us anything it is that it is the little guy that get screwed, not corrupt politicians

4)The only point in favor of Lebanon that I would concede is that GDP ratio may be overstated because the GDP is way underestimated in Lebanon (banking secrecy laws, black economy etc)

Posted by Vox P. | December 11, 2009, 8:47 pmDoes anyone have any data as to where all this money actually went after it was borrowed?

Posted by mo | December 11, 2009, 11:56 pmShadi,

Your comments leave me with no choice but to respond and “correct” the record.

(1) The article never asserted that “Hariri and his banks financed the government”. A careful reading would show that the article only posited that as one of the common positions used against the record of Hariri.

(2) I regret the error of having typed by mistake $750 instead of %00 as the size of the last Eurobond. But the point being made had nothing to do with the size of the issue and everything to say about the high rate of interest due to the low credit rating given to the country primarily as a result of its unsustainable level of indebtedness.

(3)The national debt is primarily domestic only if you insist on being very technical. The proportion of the external debt has been increasing and is currently over 45% of the gross debt. If you want to use the government figures of Net Total Debt then the external debtis already 49%.

(4) If you are interested in the details of the projection then I will be more than glad to oblige. Essentially it is based on a growth in the GDP of about 5 % each year and a conservative fiscal deficit of about 5% of the GDP annually when that is very highly unlikely to achieve.

(5) It is evident that you are not familiar with the proceedings of either the Paris Club or the London Club. Lebanon has the right and the obligation to seek a debt moratorium since it has one of the weakest capacities in the world to service its debt without reliance on “gifts” and without bankrupting the future generations.

Vox P

Thank you for bringing up the “junk” credit rating and the Lebanese obligations. I have intentionally refrained from talking about CDS and other indicators in order not to make this discussion more “technical” that it needs to be.

If the monster of national debt is not brought under control then it has the potential to consume the whole economy. Lebanon is not in a position to carry the debt burden that it is under. It is as simple as that.

Posted by ghassan karam | December 12, 2009, 1:16 amWhat is the Lebanese CDS trading at?

Posted by AIG | December 12, 2009, 1:42 amAIG,

During 2009 CDS’s in general have become much lower for most countries in the world yet Lebanon still maintains one of the highest CDS’s Higher than Greece)at 272 for each $10,000. (I believe that this is the 8or 9th highest in the world. Less than a year ago the CDS for Lebanon was at 800. I think that one reason for its not being currently higher than where it is , is a reflection on the high price of gold).

Posted by ghassan karam | December 12, 2009, 2:33 ammo,

Most of the money went into the buying of the money. A lot of people have this idea that Lebanon borrowed some 50 billion dollars and spent it on stuff, and the creditors are now waiting for us to pay it back. That’s not the case.

For one thing, we don’t actually get all the money we owe. A lot of the debt is interest, so even if we owe 50 billion, it doesn’t mean we borrowed, or spent, 50 billion.

We’ve also been paying back a lot of the debt over time, and we’ve always had to borrow more money to pay back old money.

I did some research in 2007, using financial data from 1992 to 2005. Debt financing was 38% of total government expenditure over the period, whereas salaries (including army salaries) accounted for 31%. Capital expenditure (the actual re-construction) was 12% of expenditure.

At the end of the period, the debt was at 38 billion dollars. We had spent over the same period 28 billion dollars in repayments. I had calculated that the actual cash coming in from issuing debt was 35 billion.

So in effect, we had bought 35 billion dollars for 64 billion. Someone made a lot of money on the deal. (That someone is local banks, but really also everyone with a lira account at a local bank.)

The main reason we issued debt in the early nineties wasn’t for reconstruction. It was for exchange rate stabilization. The high interest rates were justified on the grounds of creating demand for the local currency.

I myself am sceptical the high interest rates needed to be so high; and whether a stable lira was worth all this debt.

But I do have a lira account at my bank.

Posted by RedLeb | December 12, 2009, 7:24 amGhassan,

You did not create a compelling arguement as to why option 4 is the best option. How exactly would defaulting make Lebanon better off when the entire banking sector would become insolvent as a result? Why is this better than some combination of 1,2 and 3. Also is it not the case that the debt levels have been been declining in recent years? Why default now?

And finally you advocate to restructure now before the debt “evolves into a major uncontrollable crisis.” But restructuring the debt woudl cause a major uncontrollable crisis.

Posted by MC | December 12, 2009, 9:57 amGhassan, Vox P and the rest,

I am happy to take some of your points on the economics side for I am no economist, nor portend to be. My main gripe is with how the arguments are being made (by commentators too), without fully thought out research being done or the context considered. Too often us Lebanese are out to bash the status quo without full understanding the problem (as QN did in his intro to Ghassan’s article). This is quite a demanding topic and I actually think that most members of the general public are not qualified to deliberate about the situation (myself included) – better left to a panel of experts. Anyways, some further points:

* STOP comparing Lebanon to Greece. Greece is a member of the EU, has a budget deficit of c.12% or so and is rated in the ‘single-A’ category (of the three rating agencies, Fitch downgraded Greece to BBB+ from A- only a few weeks ago when they announced the 12% budget deficit which is in grave breach of EU limits, having increased after the coming of a more socialist regime to power)

* Ghassan, your statement that Lebanon’s 5-year CDS “is the 8th or 9th highest in the world…[and that] less than a year ago the CDS for Lebanon was at 800” may be correct but is out of context because a) CDS contracts exist only for sovereigns that have liquid, publically traded debt and so not every sovereign has CDS against government obligations. Your assertion would give the impression that Lebanon is at the bottom of the heap in the league of nations, except that league does not include all nations (i.e. most of Africa, Latin America and many Asian countries for example don’t have CDS, if they did, be certain they’d be multiple levels of Lebanon b) Russia’s CDS was notably above 1000+ bps during worse times of the crisis, so please keep it in context. I can assure you and know firsthand that Lebanon’s recent financing at 5.875% coupon (yield is a bit higher but less than 6%) was viewed as quite aggressive (as in they achieved a low rate) by the market and actually benefitted from the Dubai crisis (the financing was done at the same time – at the end of November) with Lebanon viewed as a safe-haven in the region when it came to public debt.

* A closer comparison for Lebanon in the public debt markets is Turkey, which is a big Eurobond issuer from the region like Lebanon

* The teams at the Ministry of Finance and the Central Bank are very qualified, know what they’re doing and are perceived this way too by market participants. This is not to say they should be given free rein, but we should have more respect for how they’re running things (goodness knows $50bn+ of investors do, and they put their money where their mouth is)

I like RedLeb’s input (not that it should matter). RedLeb, the link from my first comment shows the amount of interest to be paid in each of the comming years. It’s about $1.5bn in 2010. This amount decreases in the maturity profile as Lebanon is due to payback principal amounts, however in reality, Lebanon will refinance the debt and so this interest expense will probably remain at c.$1.5-2bn level)

Posted by Shadi | December 12, 2009, 10:44 amSome questions for the economists:

1. If we replace the internal debt with external debt for much lower interest would that work or would that cause massive inflation?

2. When Argentina defaulted didn’t it become an international pariah? Are there really no repercussions for defaulting?

3. I’ve heard the debt basically breaks down to 1/3rd to EDL and 1/3rd to salaries, and the other 1/3rd to “servicing debt”. Is this true?

Posted by Luke | December 12, 2009, 11:37 amShadi,

There does appear to be a possible lack of clarity in the minds of some readers about the relationship between national debt and fiscal deficits.

Whenever there is a fiscal deficit deficit the government issues paper in order to cover it. That is debt. As the deficits persist the national debt accumulates. In Lebanon most and times all of the fiscal deficit is as a result of debt service. Say the deficit for 2009 ends up being $5 billion and the interest on the debt $3.8 billion (it was $3 billion through Oct) then the government will borrow $5 billion and pay the $3.8 billion interest for a net borrowing of $1.2 billion. This process will go on ad nauseum as long as the government has budgets for a deficit.

If you are interested in hard figures:

The debt service already accounts for 39% of the annual budget which is expected to show a deficit of 10%. This simply means that the national debt for the year will have to increase by about $1.4 billion.

Comparisons can be helpful because they provide a meaningful reference. I brought up the CDS only in response to a specific question about it.

Yet in the final analysis it is crucially important not to give the government a carte blanche in managing the debt. Deficit finance is the most important principle in macroeconomics. This principle is not under attack,what is under attack is the irresponsible use of credit.

Posted by ghassan karam | December 12, 2009, 11:47 amShadi said:

“I’ve only skimmed through this but my points are as follows:

… Whilst it is true that the most of the debt is domestic, the assertion that Hariri and ‘his banks’ financed the government is untrue.

Shadi, rather than skimming, why not read the post carefully before you comment?

Did I make the assertion that Hariri and his banks financed the government? Go back and re-read it. I’ll wait.

Ok, now that you’ve re-read it, can we agree that I did not make that argument? What I actually said that this is one of the two prevailing narratives that one typically hears in Lebanon. You are free to disagree with it, but not to mischaracterize my position because you hadn’t bothered to read carefully. 🙂

“Too often us Lebanese are out to bash the status quo without full understanding the problem (as QN did in his intro to Ghassan’s article).

Umm, could you point out where I did this? My comment to Ghassan’s article did nothing more than introduce the issue to people who are unfamiliar with the fact that Lebanon is in debt and that this issue is heavily politicized. I wasn’t bashing anyone or anything.

Posted by Qifa Nabki | December 12, 2009, 11:50 amOf interest, today in the Daily Star.

Lebanese ministers united behind privatization plans

By The Daily Star

Saturday, December 12, 2009

BEIRUT: Finance Minister Raya Haffar Hassan said on Friday that all ministers in the Cabinet intend to proceed with the privatization program.

Hassan, who was talking to MTV, said ministers did not show reservations on the privatization program which was one of the top items in Paris III reform paper.

Sources said that Telecom Minister Charbel Nahas made some changes in the text of the ministerial statement, with special emphases on privatization.

Nahas, said sources, is not against privatization but he does not favor selling the entire telecom sector to the private sector.

Nahas hinted that he supports selling a chunk of the telecom to a consortium of companies while the government and the Lebanese public retains a stake.

Hassan also said that the issue of the public debt can be treated if necessary reforms are implemented on time and if growth is sustained.

She added that the public debt now stands at $49 billion but noticed that the debt to GDP ratio has fallen from 180 percent two years ago to 150 percent.

“Our main concern is to reduce the debt-to-GDP [ratio]. One way to do this is to expand the size of the Lebanese economy because if the economy gets bigger the cost of debt servicing will shrink,” the minister said.

Hassan said that the government has a chance to swap the Eurobonds or financing the public debt in 2010 with low yield bonds.

It is worth noting that the government recently issued two tranches of Eurobonds: one for five years at $250 million with a yield of less than six percent and another one for 15 years at $250 million with a yield of 7 percent.

“The low interest rates which we benefited from through the issuance of Eurobonds reflect the growing confidence of investors in the Lebanese economy. Even the credit rating of … has improved,” Hassan said.

The minister added that re ducing the huge deficit of the electricity sector is one of the new government’s main goals.

“We can push ahead with economic reforms provided the political and security stability are maintained,” she said.

Posted by Qifa Nabki | December 12, 2009, 12:03 pmLuke ,

You did not read the post carefully:-)

The Lebanese national debt was essentially denominated in local currency and was as a result totally owned by local institutions.This has not been the case ever 2001, at least if you use the Net Total Debt as a base.

As you rightly indicate, one attractive feature of the transformation is the lower interest rate. But as the saying goes ” There ain’t no such thing as a free lunch”. The cost for that lower interest rate is an added foreign exchange risk plus a the potential for a substantial sum of financial capital drainage. As you can see the risk reward ratio, in my opinion, argues against external debt.

What does it mean when you say that Argentina became a pariah? Were they shut out from the international financial markets for a while? Yes. Were they in a position to avoid the the use of these markets in the short -medium run? Yes because they wiped their debt slate clean , so to speak. Another example that many seem to forget is the case of Russi. They did default on their debt and precipitated an international crisis, is Russia any worse for having done that?

It is also important to keep in mind that an outright unilateral default is a last resort. There are a number of other options that ought to be considered such as debt forgivness and debt moratorium in addition to debt restructuring. I believe that the current debt load in untenable. If Lebanon does not seek a resolution then realities will force a more painful one.

There is a grain of truth to your third point. If and when EDL stps being a drain then the budget deficit will drop and the need for new borrowings will decrease. But what will happen if EDL has a miraculous turnaround but instead of using the potential savings to decrease the borrowings Lebanon decides to buy new fighter jets? My point is that a country borrows only for one reason: It is living way beyond its means. The Lebanese citizens need to understand that government cannot spend what it does not have except by borrowing from the future.

Posted by ghassan karam | December 12, 2009, 12:16 pmGhassan, when you say external debt, do you refer to the debt denominated in a foreign currency or to the debt held by foreigners?

One thing that strikes with those interest rates (5.875% and 7%) is that they are round numbers. Typically bonds are stored at a different price than their stated nominal. Are those the nominal interest rates or the actual yields?

Posted by Vox P. | December 12, 2009, 6:14 pmMC,

My failure to respond to your question was not intentional. I am often in a rush doing 4-5 things simultaneously.

I did not say that Lebanon needs to default unilaterally ASAP. I am suggesting that the current national debt situation is very serious and that Lebanon has been hanging by a thin frayed rope over the default abyss. Furthermore the future does not look to be very different from the past. In a sense it looks to be grimmer. The geopolitical risk of a confrontation with Israel as a result of the Iran Israel situation is not out of the question and the Lebanese political machine could become even more closely controlled by forces that are not friendly to the market mechanism and ideology. BUt more importantly one can expect an increase in the level of interst rates all across the world sometime next year which will add to the burden of refinancing the Lebanese debt as it becomes due. Add to all of this the certainty that the fiscal deficit will not disappear and it becomes very clear that at least a $75 billion debt is in the future of Lebanon within a decade.

Lebanon cannot afford to provide the needed expenditures on healthcare, social security, education, infrastructure for a growing population and yet pay $7 billion dollars every year in interest. Even if Lebanon is to somehow find the money to honour these obligations that would be accomplished at the expense of betraying its own children.

Given the inevitability of a looming default, by default, Lebanon must study seriously all the alternatives and options including that of default.

I do not see any signs that the Lebanese government has either the foresight or the discipline to deal with this imminent crisis. When this train wreck occurs then the only thing that would be accidental about it would be our unwillingness to take precautionary measures as to at least lessen its severity. BTW, the looming financial debacle in Lebanon is simlar to the climate control crisis. The whole world has known about its severity for over twenty years and yet we have failed to act. When the tipping point is reached and the environmental catastrophies are unleached then we have no one to blame but ourselves. This is the same identical situation in Lebanon. We need, people with vision, courage, leadership abilities and we install those that can hardly read and when they do they do not understand the words that have been written for them 🙂

Posted by ghassan karam | December 12, 2009, 6:25 pmQN: If you wish to hide behind the exact semantics of your post, then sure. You said it was one of the narratives in Lebanon (that Hariri owned banks funded much of the debt). Responsible journalism, however, would be quick to refute any such nonsense rather than peddle it and implant the impression in the reader’s mind that this may be true, when you, the author, know very well this isn’t so. I would’ve been happy if you refuted it (the narrative, if it pleases you) rather than having commentators do so.

Vox P: Bond market convention is such that coupons are typically the yield to maturity rounded down to the nearest eighth. Hence, a 5.875% bond would imply that the actual yield at issue must’ve been between 5.875% and 6%. If issued at par, i.e. 100, then the yield is the coupon. Thus, the dailystar article stating a yield of 7% for the 2024 bond may be incorrect unless the bond was issued at 100 (i’m too far away from my Bloomberg to check). There are occasions, however, when the bond is issued at a significant discount, i.e. a 3-year bond issued at a price of 90 with a coupon of 12% would yield around 15%, but this is not usual for Lebanon, especially since the coupon element is very important to Lebanese banks – they would gladly forfeit a higher effective yield for a higher coupon. Classical banking is simple – borrow short term at certain rates, lend longer term at higher rates and the margin is the profit.

Posted by Shadi | December 12, 2009, 6:50 pmVox P.

Sorry for the delay is responding to your post but as you well know week ends can be very demanding on ones time 🙂

Your guess about external vs. domestic is accurate. That is the way the Lebanese government classify the debt and I figured that following their own classification will be less confusing.(There is a solid reason why most countries issue debt in domestic currency. Why is the Lebanese government doing the reverse is difficult to understand. How can the BDL stand by and allow this behaviour is beyond me).

Your point regarding the interest was answered earlier by Shadi. I can only add that the issuers liability is the coupon rate and not the yield. This means that these last two issues were completed with a 5 7/8% coupon for one bond and a 7% coupon for the other. Bonds can trade after issuance either up or down but the issuer will always pay the coupon rate.

Posted by ghassan karam | December 12, 2009, 9:25 pmBut only after some excruciatingly painful measures to restore credibility, like when they pegged their currency to the US dollar. The Lebanese government could try that, but in the immediate afterward there would be a period when they wouldn’t be able to get virtually any credit except at usurious interest rates, or without major political strings attached.

Russia didn’t really “default” on their debt so much as they temporarily put off paying it while they re-structured the debt payment, which they could only do because of outside intervention (read: IMF support). There was not anything like what you are suggesting Lebanon do, namely completely default on the debt in the hopes of wiping the slate clean. And they only got away with it because a de-valued ruble and rising oil prices allowed them to ultimately make an economic recovery while paying down their debt.

Posted by Brett | December 13, 2009, 2:03 amBret,

I will be very brief in my response to your post since I have spoken to most of the issues that you raise in the previous posts.

The initial post suggested that unless Lebanon takes some meaningful and radical steps in dealing with its national debt problem then it will get where it is heading, A financial train wreck. As a result Lebanon must consider all measures including default as a potential solution to the current problem.

I am surprised that you bring up the possibility of a currency peg when that is precisely what we have had for decades. Lebanon has been following the policies of the Washington Consensus to a T. In a sense that has been the source of the Lebanese macroeconomic vulnerabilities.

As for the Russian example, I mentioned it since it is an example of a country that could have easily mortgaged its future in order to honour its financial obligations but decided to seek a different solution. It did and it is the better for doing so.

Posted by ghassan karam | December 13, 2009, 9:15 amWashington consensus was not about currency pegs. Quite the opposite is the case, it favored devaluations. It’s a misconception that Argentina was brought down by following Washington consensus to a T. And the Russians did not default voluntarily, they just ran out of means. It was a super painful episode and just like in the case of Argentina, the collapse of the currency allowed them to expand exports and repay their debts. And basically Bret is right about the rising oil prices. Without the oil boom, I don’t know if Russia could recover.

Posted by Nobody | December 14, 2009, 8:36 amAs I pointed out, though, Russia is an entirely different beast. Aside from the fact that they didn’t really default on their debt (they re-structured the payment schedule), they also got their asses out of the fire by a strong source of revenue that allowed them to make the payments and pay off their debt. Even then, it was extremely painful.

This is very different from what you seem to be calling for with Lebanon – wiping the slate clean.

Posted by Brett | December 14, 2009, 11:51 amThe following quote is from a report that was posted on Yahoo Finance on Dec 16, 2009:

“Argentina, Grenada, Lebanon, Pakistan and Bolivia are judged to be a little better off, but they’re saddled with still dubious B- ratings. The single-B classification at S&P means these nations are “[m]ore vulnerable to adverse business, financial and economic conditions but currently [have] the capacity to meet financial commitments.” Translation: Not good, and needs some things to go right, preferably soon. ”

It is a timely comment on the subject of this thread.

Posted by ghassan karam | December 17, 2009, 8:25 amHello

Not to be unrealistic about the challenges that Lebanon undergoes. We don’t have to be pessimistic about the situation of our country… Lebanese rating has been improved according to S&p after Doha agreement in 2008 , electing president Michael Sleiman and forming a new government. Lebanese deposits have increased last year by 20 billion $ at time the world financial crisis. A lot of people sent money to deposit as a result in the trust in the strong and flexible banking and financial sector. The assets of the Lebanese banks are $115 billion which is more than 3 times the GDP of Lebanon. The interest rates have moved down from 9% to 7% last year as a result of less risk and high liquidity and decreasing global interest rates this would lower the cost of Debt. Provided that there is political stability, there would be improvements.The ratio of debt/GDP dropped from 180% to 150% as we all heard. The economic growth in 2009 was 7% last year thanks largely to tourism, Banking sector and political stability. If they privatize the electricity sector, and produce electrical energy through gas and solar energy, they would drop down the high cost of producing electricity inefficiently…

Thanks to the good banking sector that can finance the Lebanese debt and market Lebanese Euro bonds internationally…

The Lebanese are intelligent and creative people , and any reforms and projects done by the so called national unity government would attract a lot of Lebanese abroad to return and work in Lebanon. we hope that political stability can revive and mobilize tourism and investments in Lebanon.

On the other hand,I am not saying that the situation would improve so easily , it needs some time and some effort…Just Hope that God would bless our country …

Bye

Posted by wael | February 20, 2010, 5:21 pmWael,

Take my word for it God has nothing to do with whether Lebanon prospers or not:-)

She has lost interest in her creation.

Posted by Ghassan Karam | February 20, 2010, 7:51 pm